Budget your money like a pro? Bro, I laughed at that phrase exactly 47 days ago when my bank app sent me a push notification that literally just said “help.” I’m sitting here in my 8×10 cinderblock palace at State U, window AC rattling like it’s personally offended by August, and my left sock has a hole big enough to smuggle contraband. Anyway.

Why I Used to Budget My Money Like a Drunk Toddler

Real talk—freshman year I thought “budget your money” meant buying the generic Pop-Tarts instead of name brand. Like, congratulations self, you saved 63 cents. Meanwhile I’m dropping $14 on late night UberEats because “walking across campus at 1AM is basically a hate crime.”

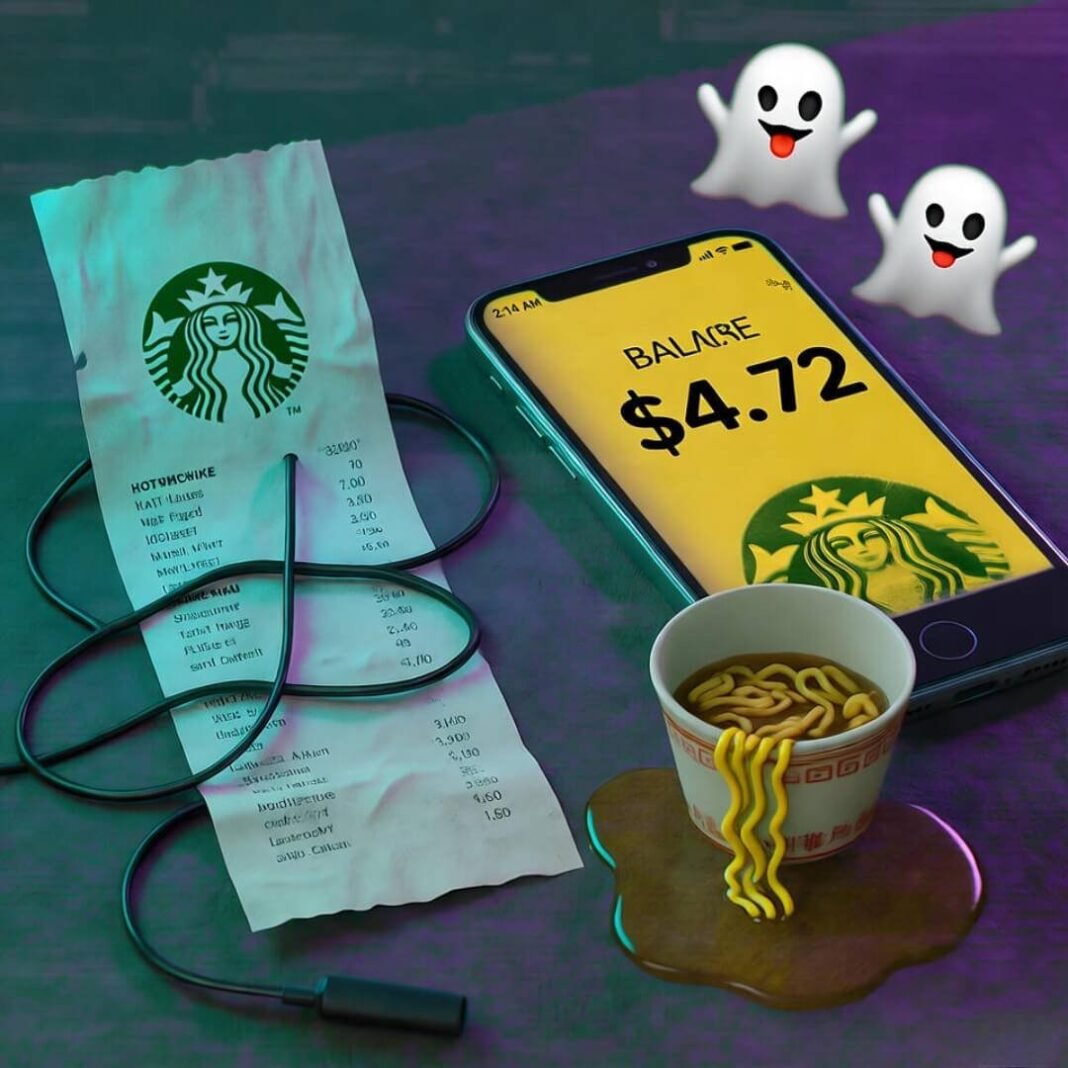

I distinctly remember the Taco Bell incident. 2:47AM, library all-nighters got me feral, ordered a Crunchwrap Supreme combo AND those cinnamon twists because YOLO. Woke up to a $23 charge and exactly one regret. My roommate found me stress-eating the cold leftovers while calculating if plasma donation paid enough for rent.

The Apps That Saved Me From Budget Your Money Hell

- Mint (now kinda Credit Karma but whatever): Links all my accounts and screams at me in red when I’m being dumb. Saw “Dining Out: $287 this month” and actually gasped like a Victorian lady.

- YNAB (You Need A Budget): Costs money to save money, the ultimate flex. Forces me to give every dollar a job—rent gets $400, ramen gets $50, “don’t be an idiot” gets the rest.

- Google Sheets (free and chaotic like me): Made a template called “Don’t Starve Challenge 2025” with tabs for every dumb category. Color coded red for “about to cry.”

My Actual Budget Your Money System (Works 60% of The Time)

Look, I’m not about to pretend I’m some finance bro with a five-year plan. But here’s what stopped the bleeding:

- The 50/30/20 rule but make it depression: 50% needs (rent, phone, not dying), 30% wants (but like, one want), 20% savings (or in my case, “future me’s therapy fund”).

- Cash in envelopes like it’s 1952: $40 for food, $20 for fun, $10 for “surprise BS.” When the fun envelope is empty? Guess we’re having a personality.

- The 24-hour rule: See cute thrifted jacket? Screenshot, sleep on it, wake up and realize I don’t need to cosplay as a 90s music video extra.

Pro tip: I budget my money for coffee separately because if you take away my $4 iced oat milk latte, we’re gonna have a problem. Call it self-care or call it addiction—tomato, tomahto.

Budget Your Money Hacks That Feel Like Cheating

- Campus free food calendar: I have a shared Google Cal with every club meeting that serves pizza. Anthropology Club on Thursdays? Suddenly I’m fascinated by kinship structures.

- Textbook piracy (don’t @ me): Library reserves + older editions + that one senior who scans chapters. Saved $400 last semester, bought groceries instead.

- “Friend tax”: Cook for your squad once a week, they Venmo you $5 each. My garlic fried rice game is undefeated.

The Time I Budget My Money So Hard I Had $12 Left for Fun

Spring break was approaching. Everyone’s posting Miami stories. Me? Budgeted $87 for the entire week. Ended up at my cousin’s couch in Jersey, discovered Wawa has $5 hoagies that slap, and accidentally had the best time because zero FOMO when you’re not refreshing Instagram in a club bathroom.

When Budget Your Money Feels Impossible (Spoiler: It Kinda Is)

Some months rent goes up, fin-aid is late, and your car decides it identifies as a brick. That’s when I text my mom “hypothetically how mad would you be if I sold feet pics” (joke… mostly).

The real tea? Budget your money isn’t about perfection. It’s about not having that stomach drop when you open your banking app. It’s about choosing which stress you want—stress about money or stress about never having stories.

Okay But Actually Do This Today

Grab your phone right now (yes, while you’re procrastinating org chem). Download whatever app won’t judge you. Take 10 minutes to write down:

- What came in this month

- What has to go out

- What you’re pretending isn’t a subscription (looking at you, that astrology app)

Then set one dumb rule. Mine this week? No buying food that costs more than my dignity (currently valued at $6).

Budget your money like the messy, ramen-fueled, slightly delusional pro that you are. Future you is already high-fiving present you—probably over a slightly less sad bowl of noodles.

Now go touch some grass. Or at least calculate if you can afford the bus fare to get there.

References: YNAB’s student guide, Consumer Financial Protection Bureau student budgeting tools, my own tears