Credit card comparison is my current obsession, and I’m writing this from my shoebox of an apartment in Queens, where the radiator’s hissing like it’s possessed and my dog, Taco, is chewing on a squeaky toy that’s driving me nuts. I’m no money genius—last week I bought a $7 latte and forgot to tip the barista, oops—but I’ve been drowning in credit card comparison websites, trying to find a card that fits my messy life. Between my takeout addiction, occasional travel fantasies, and a bad habit of misplacing bills, I’ve made some epic screw-ups. Here’s my unfiltered, slightly embarrassing take on doing a credit card comparison, straight from my caffeine-fueled brain.

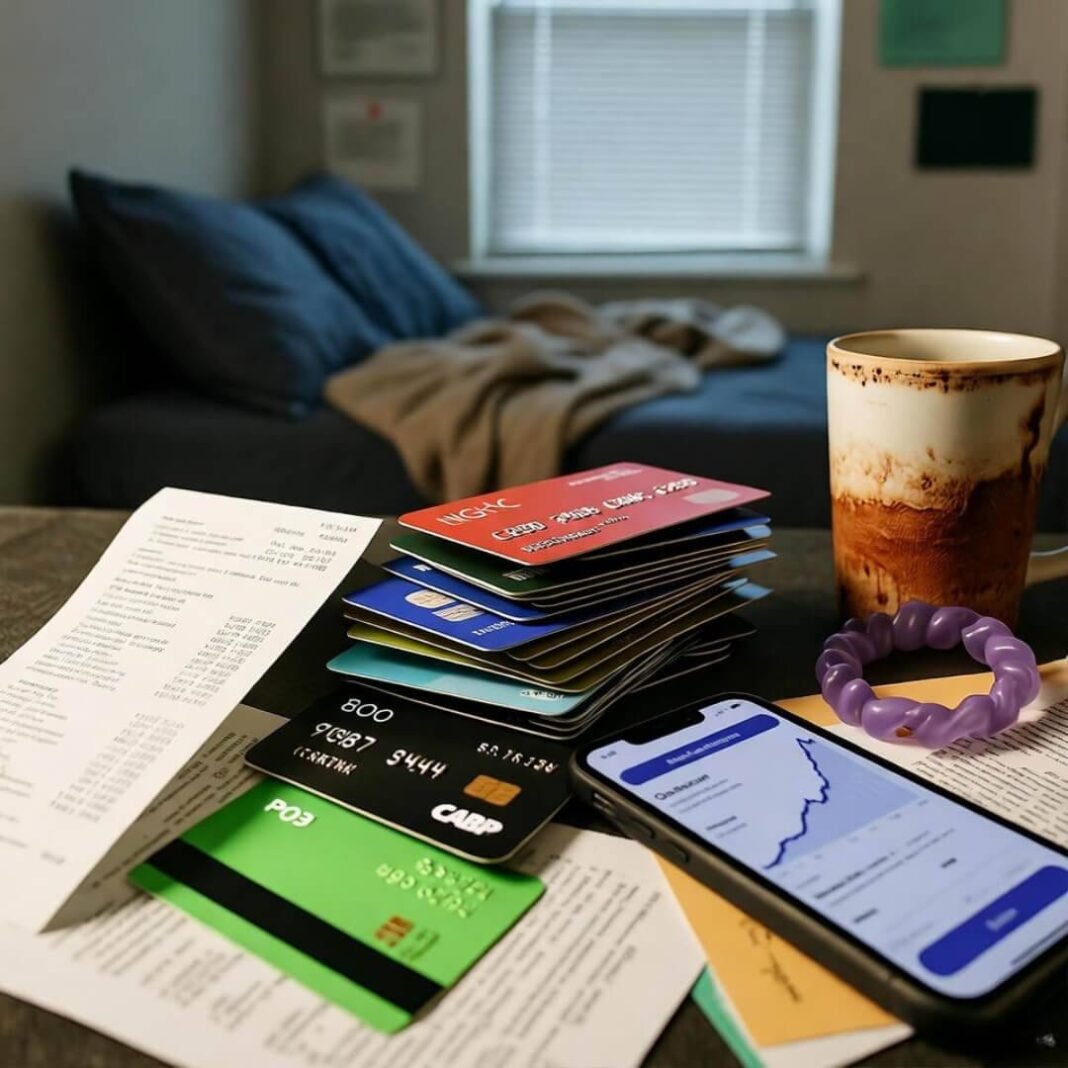

I’m sprawled on my couch, surrounded by empty seltzer cans, and my laptop’s screen is smudged from me poking it like an idiot. The air smells like burnt toast (don’t ask), and I’m pretty sure I just saw a moth fly out of my mail pile. Let’s dive into this credit card comparison madness, ‘cause I’ve got stories and regrets to share.

Why Credit Card Comparison Feels Like a Bad Reality Show

Picking a credit card is like auditioning for a show you don’t even want to be on. I thought I had it figured out last year when I got a travel rewards card ‘cause the ad had a beach sunset. Big mistake. I used it to buy tacos and got slapped with a $95 annual fee. I’m still mad about it. Credit card comparison is about knowing who you actually are, not who you wish you were.

Here’s what I learned after too many nights on NerdWallet and stress-eating Goldfish crackers:

- Your Lifestyle’s the Boss: If you’re like me, spending on DoorDash and coffee, get a card with dining rewards. If you’re always on planes, go for travel perks.

- Fees Are Evil: Annual fees, foreign transaction fees—they’re like stepping on Legos. I once paid $80 for a card I used twice. Yikes.

- Rewards Can Suck You In: That 5% cash back sounds amazing until it’s only for, like, pet supplies, and you’re allergic to cats.

My (Super Imperfect) Tips for Nailing a Credit Card Comparison

I’m no pro, but I’ve flubbed enough to have some advice. Here’s how I do credit card comparison now, after some major faceplants:

Step 1: Own Your Spending Habits

Be real with yourself. I thought I was a “world traveler” until I saw my bank statement—75% takeout, 20% random Amazon buys. Cards like the Discover it Cash Back (see Discover’s site) are great for my foodie nonsense with no annual fee.

Step 2: Compare Cards Like You’re Picking a Bar

You wouldn’t hit a bar without checking the vibe, right? Same with cards. I scribbled a messy list of rewards and fees in a notebook—felt like a wannabe accountant. Bankrate has dope tools for comparing cards without losing your mind.

Step 3: Read the Damn Fine Print

I got burned by a “no interest” card with a 3% balance transfer fee. Nearly choked on my ramen when I saw it. Check the terms on Credit Karma—they don’t sugarcoat the traps.

Cards I’m Kinda Into (and Why)

Here’s a few cards I’m digging, based on my, uh, unique life:

- Chase Sapphire Preferred: Perfect for my travel dreams (that I’ll probably never act on). The points are versatile, and the bonus is sweet. Check Chase’s site.

- Capital One Quicksilver: Flat 1.5% cash back on everything. No thinking required, which is great for my scatterbrain. See Capital One’s page.

- Amex Blue Cash Everyday: Good for groceries, ‘cause I’m always buying snacks. Look at Amex’s site.

These work for me, but do your own credit card comparison—your life’s probably less of a mess than mine.

Screw-Ups I Made So You Don’t

Oh man, I’ve got regrets. I once got a store card for a mattress shop ‘cause I wanted a “free” pillow. Ended up with a 28% APR and a $300 bill for a nap I didn’t take. Also, I applied for a card without checking my credit score and got rejected—felt like getting dumped. Use Experian to see what you qualify for.

And don’t chase rewards like I did. I got a card for airline miles, but the airline doesn’t even fly out of LaGuardia. Total clown move.

Wrapping Up This Credit Card Comparison Circus

Credit card comparison is a lot, but it’s worth it to avoid getting hosed. I’m sitting here with Taco drooling on my jeans, my desk looking like a thrift store explosion, and I’m still learning. My advice? Know your spending, check the fine print, and don’t fall for ads with beach vibes. Start with NerdWallet or Bankrate for solid credit card comparison tools.

My Bad: Okay, I probably rambled too much, and I might’ve mixed up “cash back” and “cashback” earlier (ugh, sorry). Also, Taco just knocked over my seltzer can, so if this post feels like a hot mess, that’s just me. Credit card comparison is wild, and I’m barely keeping it together. Later, y’all.