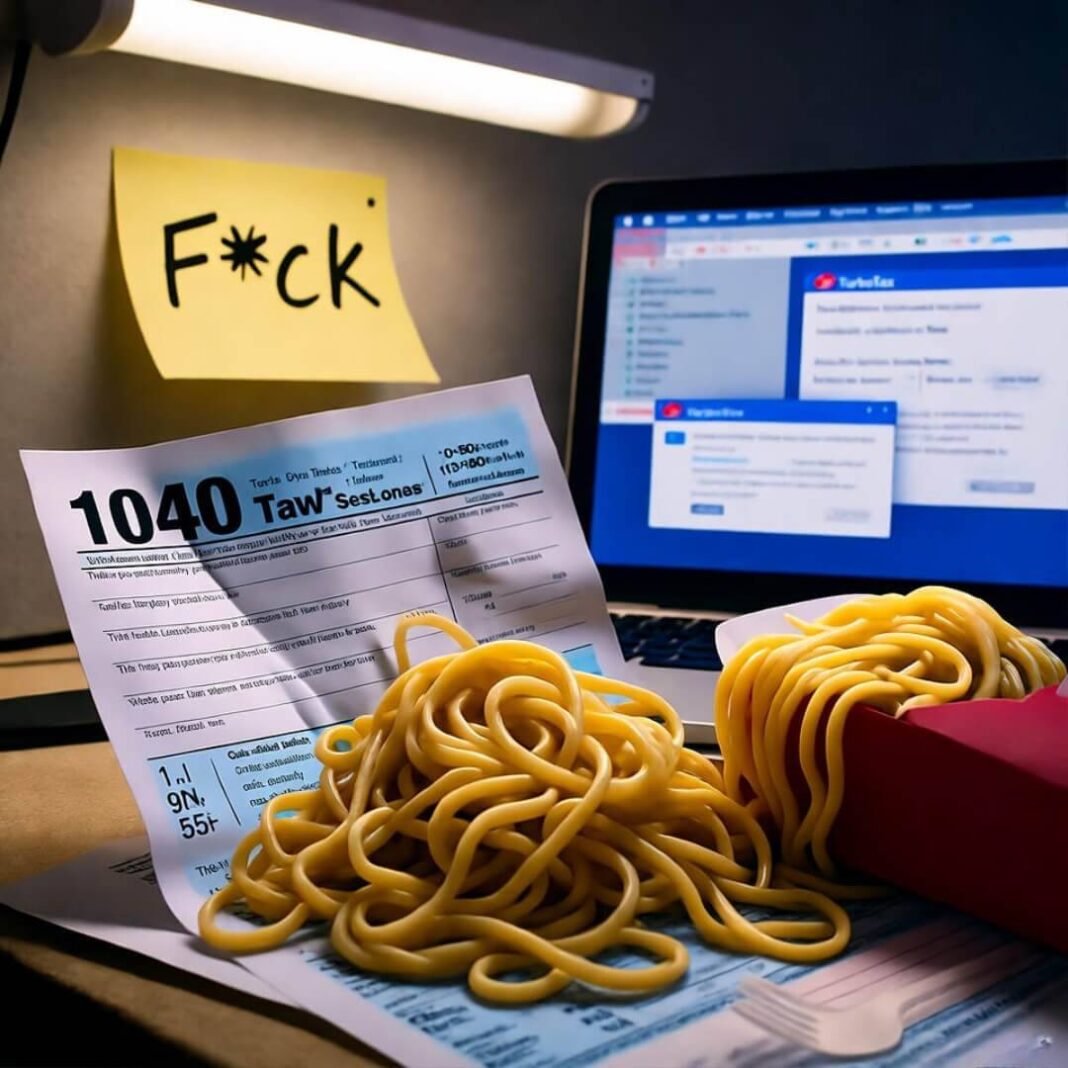

Tax filing mistakes are literally the reason I’m stress-eating cold lo mein straight from the carton right now in my Brooklyn apartment—seriously, the sesame sauce is dripping onto my 1099 and I don’t even care anymore. I’m staring at this glowing screen, the radiator’s clanking like it’s judging me, and I’m realizing I’ve made every single rookie tax error in the book. Like, last year I straight-up forgot to report the $37 I made selling old band tees on Depop because “it’s not real income, right?” Wrong. The IRS sent me a love letter and suddenly I owed $400 in penalties. Anyway, here’s my unfiltered brain dump on the tax filing mistakes that still haunt me—so you can dodge the same dumb bullet.

Why Tax Filing Mistakes Hit Different When You’re Broke

Look, I’m not some CPA in a suit. I’m a 32-year-old freelancer who once tried to deduct “emotional support oat milk” as a business expense. Spoiler: the IRS laughed. My biggest filing blunder was assuming “self-employed” meant “taxes are optional.” I shoved every receipt into a shoebox under my bed—Starbucks, Uber, that one $12 bodega sandwich I ate while crying over invoices—and called it “organized.” Come April, I’m digging through cat-hair-covered receipts at 1 a.m., radiator hissing, neighbor blasting reggaeton. Pro tip: use an app. I finally caved and started scanning everything into a Google Drive folder labeled “TAX DOOM 2025.” Game-changer.

The Deduction Disasters That Still Make Me Sweat

Okay, confession: I once deducted my entire Netflix subscription because I “watched The Office for work vibes.” The auditor’s note literally said “LOL no.” Another gem? I tried writing off my gym membership as “mental health maintenance for gig economy stress.” Denied. Here’s what actually worked after I stopped being a chaotic gremlin:

- Home office: Measured my desk with a Chipotle burrito wrapper—turns out 42 square feet is deductible if you’re legit.

- Mileage: Kept a mileage log in my Notes app like “3/12 – drove to client mtg, cried in parking lot, 14 mi.”

- Supplies: Finally stopped deducting “vibes” and stuck to printer ink and Adobe fees.

Forgetting Forms = Instant Regret

Last year I filed without my 1099-NEC because “the client said they’d send it eventually.” They didn’t. I owed $800 in underreported income plus a $50 late penalty that felt like a personal attack. Now I harass clients in February like a tax Karen: “Yo, where’s my 1099? I need it yesterday.” Also, Schedule C? I used to skip the “cost of goods sold” section because math. Turns out that’s where you deduct the $200 you spent on Canva Pro. Who knew?

The “I’ll Just Google It” Spiral

3 a.m. Google searches are not tax advice. I once convinced myself crypto losses were “fully deductible against cat food expenses.” Narrator voice: they were not. Found this IRS page on virtual currency after I already filed—turns out I owed capital gains on that $12 Dogecoin I forgot about. Save yourself the panic and bookmark actual IRS resources instead of trusting Reddit randos.

Rookie Tax Errors Even Smart People Make

- Filing single when you qualified for head of household (hi, that was me pre-cat adoption).

- Forgetting state taxes—NYC hit me with a $200 “welcome to adulthood” fee.

- Rounding numbers because “close enough.” The IRS loves exact pennies.

The Extension Trap (aka Procrastination Tax)

I’ve filed extensions three years running because “I’ll be more organized in October.” Lies. October me is just as chaotic, except now I’m hungover from Halloween candy. If you’re gonna extend, at least estimate and pay something—otherwise you’re hit with failure-to-pay penalties that stack like Jenga.

My 2025 Tax Filing Mistakes Prevention Plan (So Far)

- January: Open a “TAXES OR BUST” folder. Scan every receipt the day I get it.

- February: Beg for 1099s like my life depends on it (it does).

- March: Book a cheap CPA consult on Upwork for $75—just to sanity-check my mess.

- April 1: No takeout until I file. (Currently failing this one—sesame noodles are calling.)

Anyway, Don’t Be April 14 Me

Tax filing mistakes turned me into a radiator-haunting, lo-mein-grease-fingered disaster, but I’m clawing my way out. If I can stop deducting oat milk and start scanning receipts, so can you. Seriously, set a reminder right now to check your 1099s. And if you’re spiraling at 2 a.m., text a friend or hit up the IRS Free File—it’s legit free for most of us.

Catch you in the comments if you’ve got your own tax horror stories. I’ll be here, eating cold noodles, judging myself in 4K.